Atlanta BeltLine Inc. officials on Monday held the first of several study sessions on a proposed BeltLine Special Services District public financing mechanism.

Sign up now to get our Daily Breaking News Alerts

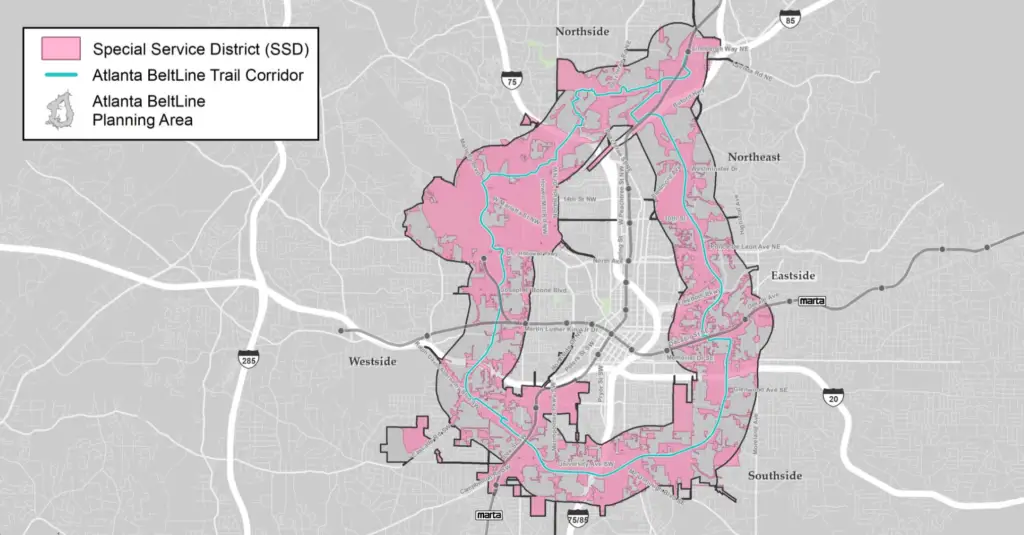

Proposed last month, the SSD would impose a property tax increase of about 2 percent for commercial and multifamily owners in the Atlanta BeltLine Planning Area, a zone running about half a mile to each side along the 22-mile loop.

Officials say the public financing tool is necessary to keep the $350 million trail corridor project on schedule. While the Atlanta BeltLine Tax Allocation District is expected to raise $100 million, the SSD would directly raise $100 million, a total that would be matched by funds from philanthropic partners. The remaining $50 million balance would be covered by federal, state, and local public financing sources and grants, according to ABI

Scheduled for completion in 2030, the BeltLine project as a whole, which will create an estimated 5,600 units of affordable workforce housing units, 30,000 permanent jobs, 48,000 construction jobs, and 1,300 acres of greenspace, among other community benefits, is expected to cost $4.8 billion and create an estimated $10 billion in economic development.

“The challenge we are facing is a funding gap of about a billion to a billion-and-a-half dollars from what was originally estimated,” ABI Director of Economic Development Kara Cooper said Monday evening. “On TAD funding alone – our tax allocation district, which has been our main source of funding for the project – the BeltLine will not be able to deliver on all of our promises.”

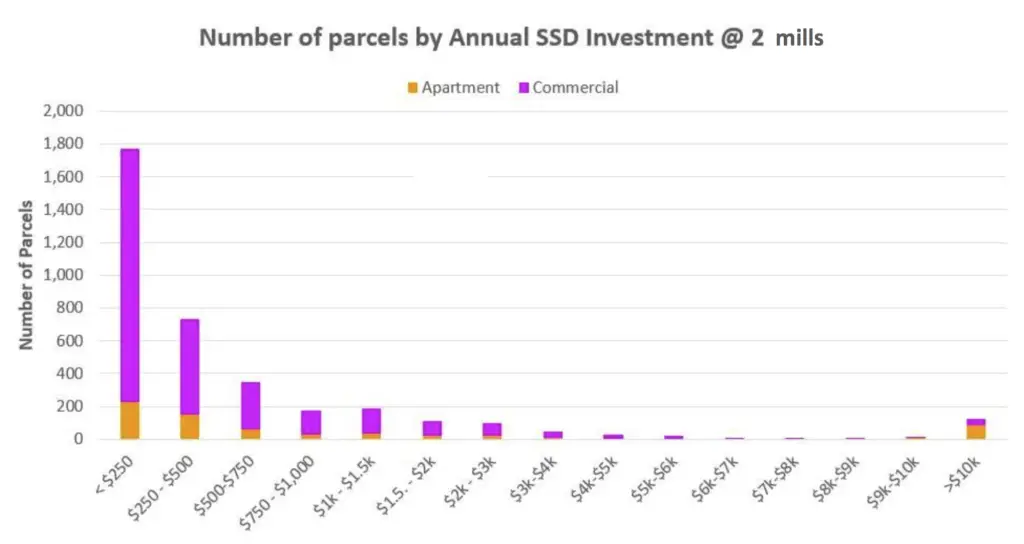

The SSD would apply to 5,088 parcels, 1,398 of which, including single-family, townhome, and condo properties, would be exempt, ABI says. Almost half of the remaining 3,690 parcels would contribute less than $250 annually in SSD taxes, with the top 3 percent generating about two-thirds of revenue, according to ABI.

Even so, the proposed tax district has the support of large Atlanta-based commercial real estate company Jamestown.

While Community Improvement Districts are a more common special funding tool in metro Atlanta, SSDs have been used in and around the city, like to fund infrastructure around the Braves new ballpark. Though proposals for such tax districts often go to the ballot, the Atlanta City Council would be able to implement the BeltLine SSD without such a vote, ABI Director of Government Affairs Jill Johnson said Monday evening.

Atlanta City Councilman Antonio Brown said during the event that he supports the the BeltLine SSD, which also has the support of Atlanta Mayor Keisha Lance Bottoms.

“I think the Special Services District is such an incredible opportunity,” he said. “It speaks to the BeltLine commitment for the vision of mobility, opportunity, and affordability.”

Atlanta BeltLine Partnership Executive Director Rob Brawner also commented on the importance of the BeltLine SSD.

“Time is running out, and, again, with this tool, if City Council approves it, we’ll have the ability to deliver what we genuinely believe to be positive benefits to the residents and businesses in Atlanta,” Brawner said.

The Monday evening virtual event, which covered information specific to the Westside portion of the BeltLine project, will be followed by several additional study sessions from this week to the first week of March.

-

Facebook

-

Twitter

-

LinkedIn

-

Gmail

-

Facebook

-

Twitter

-

LinkedIn

-

Gmail

-

Facebook

-

Twitter

-

LinkedIn

-

Gmail