Stryant Investments, LLC, a Georgia Based Company, has submitted a request for a $1.5 million Invest Atlanta Housing Opportunity Bond, which will assist in the costs associated with the demolition and redevelopment of the 111 Moreland Avenue property into a multifamily affordable housing project.

Sign up now to get our Daily Breaking News Alerts

Early in the development review process, Invest Atlanta’s Urban Residential Finance Committee had this request listed as a discussion item during their November 10th meeting.

The Housing Opportunity Bond is a financial tool approved by the Invest Atlanta Board of Directors in 2021 to assist in closing the financial gap needed to make affordable workforce housing possible. The program includes $50 million Taxable Draw-Down Bonds and $100 million Taxable Revenue Bonds. According to Invest Atlanta documents, most of the funds will be allocated as loans for projects and developments. Repayments to the loans are collected in a separate account and reallocated to support the needs of other programs, including down payment assistance and multifamily gap financing.

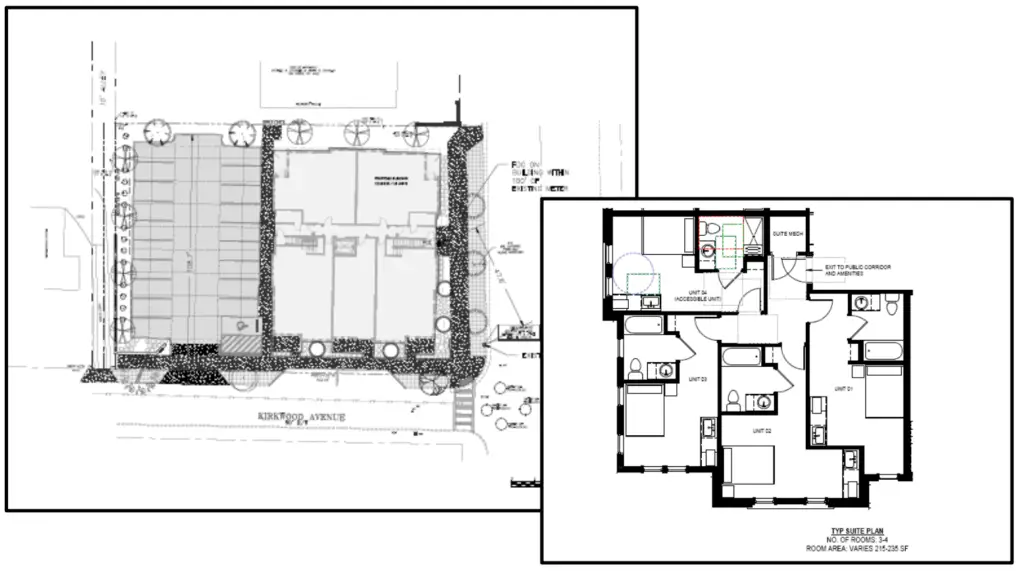

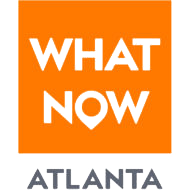

According to application documents, the existing single-family home located at the corner of Kirkwood Avenue SE and Highway 23 will be demolished, and a 45-unit apartment complex will transform the site. A typical unit contains 3-4 bedrooms and baths. In addition, all units will benefit from a central laundry facility, lounge kitchen on each floor, picnic area, bike storage, and energy-efficient appliances.

Of the 45 residential units, 24 will be rented at those who are at 30% AMI or below at a rate of $960. Those at 60% AMI or below may qualify for one of 18 units with a monthly rate of $755. Three units will be market rate at a rental of $1,050, according to application documents.

As presented to the Invest Atlanta Committee, the development budget revealed that the project’s total construction costs are $5,781,148, including $830,000 in acquisition costs. The project is in financial collaboration with Enterprise Community Partners, Peach State Credit Union, City of Atlanta HOME, Partners for Home Grant, and the Atlanta Affordable Housing Fund.

The Stryant Investment website states that the Company has completed over 200 single-family rehabilitation projects, 500 apartment unit renovations, and 46,000 square feet of commercial construction with public and private sector partnerships. In addition, their rehabilitation portfolio consists of the Academy Lofts, as reported by What Now News in May.

The anticipated completion of the multifamily development is in 2023, after an estimated construction period of eight months.

-

Facebook

-

Twitter

-

LinkedIn

-

Gmail

-

Facebook

-

Twitter

-

LinkedIn

-

Gmail

One Response

Are there only 19 parking spots for a potential 157 people living there?