Developer Rea Ventures Group is seeking approvals for an $18.5 million tax-exempt loan from Invest Atlanta to build a 116-unit mixed-income affordable housing project in Reynoldstown.

Sign up now to get our Daily Breaking News Alerts

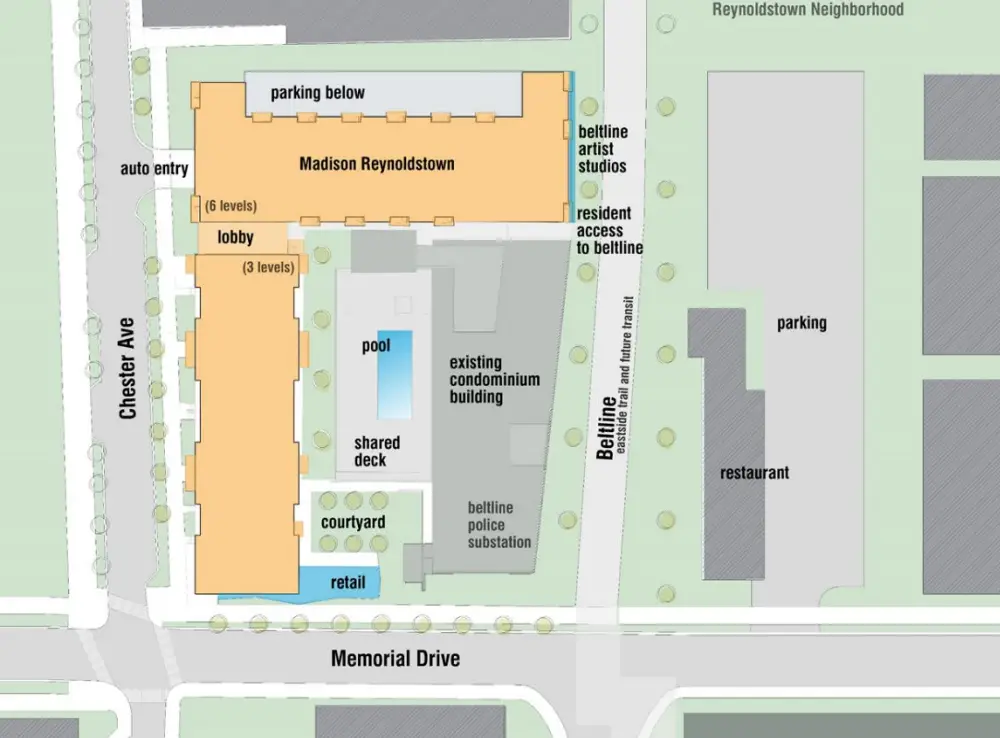

The $37.8 million project went before Invest Atlanta’s Urban Residential Finance Authority as a discussion-only item this week, according to its agenda. It would take 18 months to construct and would have an expected opening in 2022 at 872 Memorial Drive, SE, a fact sheet for the project shows.

Named Madison at Reynoldstown, the project would contain 71 one-bedrooms, 36 two-bedrooms, and nine three-bedrooms offered to households at 30 percent, 60 percent, or 80 percent or below of area median income. The development’s 60-percent AMI units, for example, would have expected rents of $861 for one-bedrooms, $1,026 for twos, and $1,177 for threes, plans show.

The project has been in planning since 2019, when Rea Ventures initially sought a $17 million tax-exempt loan from Invest Atlanta. The Atlanta Business Chronicle reported earlier this year that rising labor and construction materials costs have led it to seek an additional $1 million in financing.

The Reynoldstown project would rise alongside the Atlanta Beltline Eastside Trail and adjacent to an existing condominium community. Designed by architecture firm Praxis3, it would also offer amenities including a business center, community rooms, and a fitness center.

Other major budgeted funding sources include state and federal tax credit equity and a national housing trust fund grant, the project fact sheet shows.

-

Facebook

-

Twitter

-

LinkedIn

-

Gmail

3 Responses

Wow, this looks a great project for affordable housing in a really popular area!

Income diversity makes for a healthy neighborhood!

In theory it does, however the wants and needs of a market rate unit/resident is completely different from those in affordable housing as well the value structure of a community in it’s maintenance and future investments. This looks great on paper however as a next door neighbor, are your goals and drives the same as those of some other socioeconomic groups needs based on the exposures of either. This is not going to end well. A prime example is Capitol Gateway Apartments, as they age the demographics of it’s residents has over the years been consistently declining to it’s original base residents of the original community. A project!!!

There are a lot of people in the service industry, students, creatives, etc that could use housing like this.

I think maybe being very selective about who you rent to would make a big difference.

I also don’t think this neighborhood would let this place turn into a crime infested drug den.

With good management, not all affordable housing needs to turn into the projects.

Fingers crossed– I’m trying to stay optimistic on this one!